Property Tax Math Problems

The solution to this real estate math problem is. Problems With Property Taxes.

Fractions Decimals Percentages 7th Grade Math Khan Academy

Learn to calculate property taxes using assessed value and Florida Homestead tax exemptionsGold Coast Schools is Floridas leader in real estate education.

Property tax math problems. Due to the COVID-19 pandemic the Division is currently closed to the public. It will not take into account our states tax due dates April 30 and October 31. 1 Acre 43560 square feet.

This video is part of a series of math calulation problems wev. This is the currently selected item. Rate Annual taxes divided by Assessed Value 1100 divided by 80000 01375 x 100 1375 per 100 of assessed value b C.

Question 1 of 3. Service payments in lieu of taxes Owners of property subject to TIF required to pay service payments in lieu of taxes Paid in the same amount and collected in the same manner as real property taxes TIF is therefore a way to focus otherwise dispersed tax money on specific local improvements. Taxpayers may use the secure drop box located in the lobby of the 77.

City of Columbus Income Tax Division 77 N. A house has an assessed value of 600000. You will receive your score and answers at the end.

Monday through Friday 900 am. Other Useful Real Estate Math Formulas. Property Tax Rate Assessed Value Mill Rate Assessed Value Assessment Market Market Value 1 mill 11000th of a dollar or 1 in property tax.

If the property tax is 8 percent calculate the. Terms in this set 3 Any property tax proration question on the exam will be based on a tax year running from. January 1 through December 31.

The real estate math licensing exam may have the following problem. Real Estate Math Practice Problem. Vacancy rate and capitalization rate not needed to work this problem.

Discount markup and commission word problems. Each unit rents for 750 per month. Choose an answer and hit next.

The property management agreement calls for the manager to be paid 7 commission for all rents collected at a 10-unit apartment building. Calculating Transfer Taxes for a 320000 Property. 345000 x 210 100 7245.

1 Math for General Personal Property Real Property Certification Exams 1 - Calculate Assessment Level. Gross Rent Multiplier Property Price Gross Annual Rental Income Annual Gross Rental Income Monthly Rental Income 12. Calculating property taxes will most likely be a question on your real estate licensing exam.

Front Street 2nd Floor. 1860 annual taxes divided by 80000 02325 or 233 d. Word problems and thousands of other math skills.

The County charges a recordation tax of 015 per 100 to buyers and a grantors tax of 125 per 100 to sellers. If youd like more practice with real estate taxes download our 125 Real Estate Math Problems Solved Click here to get access to 125 real estate math practice problems. Property Tax Rate assessed value x mill rate Assessed Value assessment rate x market value 1 mill equal to 11000th of a dollar or 1 in property tax.

Assuming 1 unit was vacant 2 units were rented for 21 days and the remaining were fully leased for the month how how much did the property manager earn. Local governments use property tax revenue to fund important services and. Assessed value of the property x tax rate taxes due Because different municipalities in your state may use the three different methods here are three problems using mills per dollar of assessed value dollars of tax per hundred dollars of assessed value and dollars of tax per thousand dollars of assessed.

614 645-7193 Customer Service Hours. For homeowners and other property owners property taxes are an unavoidable fact of life. Improve your math knowledge with free questions in Sales and property taxes.

Math - proration problems. Division of Income Tax home page. Gross Rent Multiplier Calculator.

Solutions to property taxation practice problems b B. Calculate the transfer taxes for Sally and. Equivalent expressions with percent problems.

Sally plans to purchase Bobs home for 320000 in Sweetwater County. Problem solving - use acquired knowledge to solve property tax practice problems Reading comprehension - ensure that you draw the most essential information from the. Area ft2 length ft x width ft Perimeter side side side side Commission.

Taxes Assessed Value x Tax Rate. If the effective tax rate is 18 and the tax. Tax and tip word problems.

Pdf Neural Math Word Problem Solver With Reinforcement Learning Semantic Scholar

Quiz Worksheet How To Calculate Property Taxes Study Com

Real Estate Math Guide Printable Real Estate Math Cheat Sheet Real Estate License Wizard

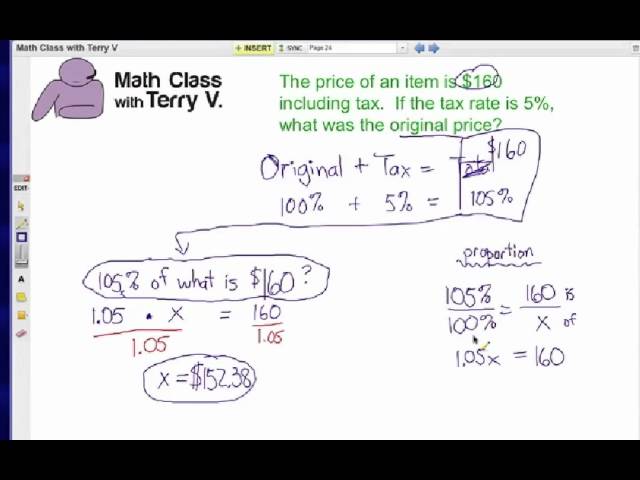

Discount Sales Tax Tip 7th Grade Pre Algebra Mr Burnett

Sales Discounts Tax And Tip Homework Common Core Common Core Math Standards Money Math Worksheets Math Word Problems

6th Grade Math What Is Tax And How To Calculate Tax Youtube

Real Estate Math Formulas Practice Questions Examples Vaned

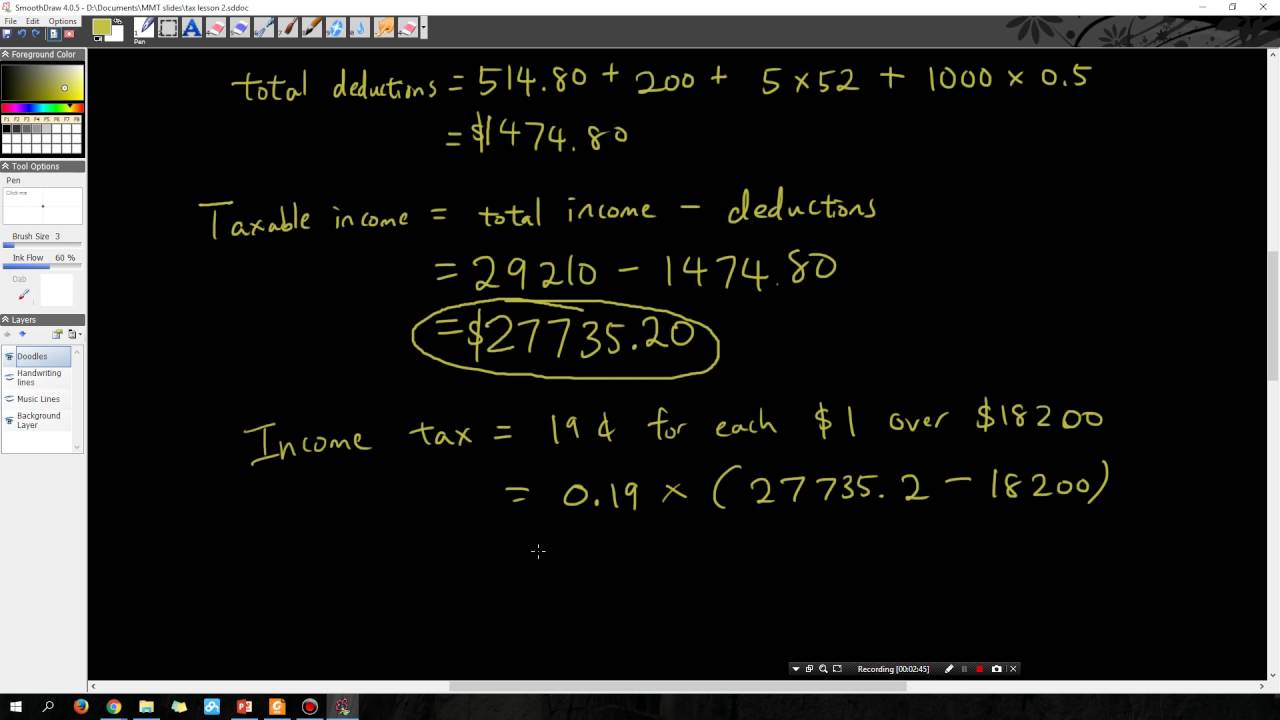

Maths A Tax Lesson 3 Calculate Income Tax Youtube

Sales Tax Word Problems Word Problems Math Word Problems Word Problem Worksheets

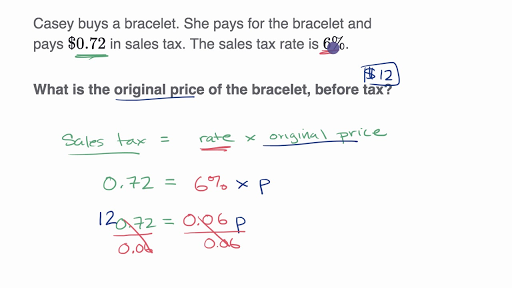

Percent Word Problems Sales Tax Discount Finding The Original Price Youtube

Real Estate Math Formulas Practice Questions Examples Vaned

Https Www Vaned Com Documents Real Estate Math Study Guide Pdf

Tax And Tip Worksheets 7 Rp 3 Teaching Inspiration Middle School Math Word Problems

How To Find Original Price Tax 1 Youtube

Money Math Solve Sales Tax Word Problems Worksheet Education Com Money Math Word Problem Worksheets Money Math Worksheets

Real Estate Math Video 5 How To Calculate Property Taxes Real Estate Exam Prep Videos Youtube